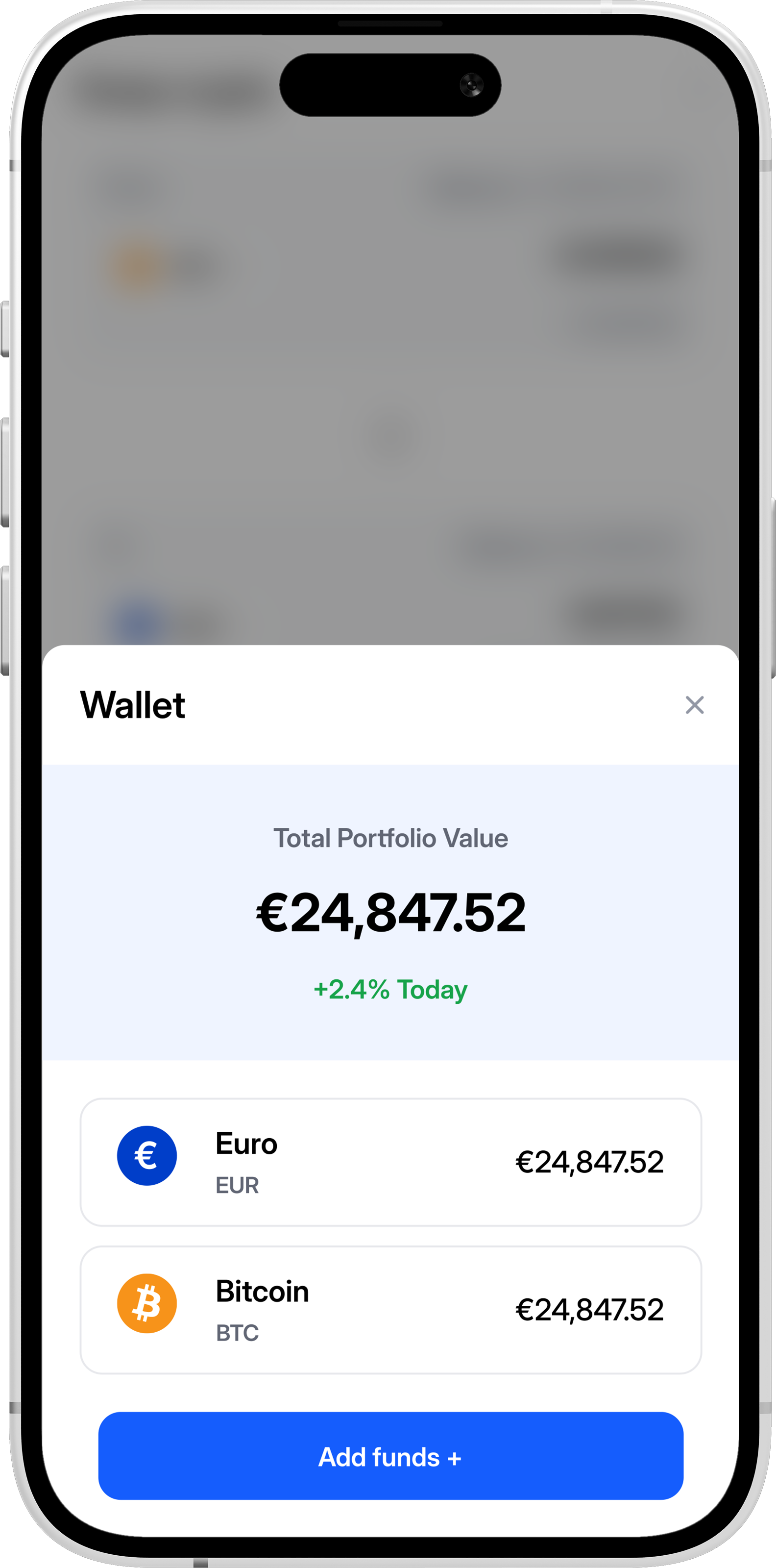

Multi-Currency Accounts for Businesses

Hold and move funds across currencies with ease; without the cost and friction of legacy banking.

Banking Without Borders

SimpleBlock provides named IBANs in 30+ currencies, enabling businesses to manage global receivables and payments with less friction and cost.

Dedicated IBANs

Open multi-currency accounts under your company’s name for 30+ currencies.

Local Payment Networks

Receive funds through SEPA, GBP Faster Payments, and US rails in minutes.

Stablecoin Payments

Move stablecoins directly into or out of your bank accounts; bridging digital assets with your everyday business finance seamlessly.

How it Works?

Find answers to common questions about our payment, banking, and crypto solutions.

Onboarding

Set up your enterprise account with multi-currency IBANs issued under your company’s name.

Fund & Operate

Receive payments via local rails, fund in multiple currencies, or settle stablecoins directly into your account.

Move & Manage

Consolidate balances and make payouts globally; optimising treasury without the delays and costs of legacy banks.

Available currencies

Our coverage spans the following major currencies

Africa & Middle East

Asia

Europe

North & South America

Oceania

FAQ

Answers to the most common questions about using SimpleBlock’s multi-currency IBANs for global operations.

We provide multi-currency account management, international wire transfers, payment processing, and treasury management solutions designed for institutional clients and enterprises.

You can hold balances in 23+ major currencies within your account. Each currency is segregated and can be managed independently with detailed reporting and analytics.

Client funds are held at regulated banking partners and are subject to applicable deposit insurance schemes based on jurisdiction. We provide detailed information about fund protection for each supported region.

Talk to Our Team

Connect with our specialists to structure and execute your digital asset strategy.

Contact Now ›