Institutional On/Off-Ramp

Solutions

Fiat-to-digital asset rails designed for financial institutions, fintechs, and enterprises.

Build trusted, compliant, and scalable interfaces that move money efficiently.

Built for Scale & Trust

SimpleBlock enables banks, fintechs, and enterprises to access robust infrastructure for bridging fiat and digital assets.

Global Reach

Access new markets instantly, without needing local banking partners for every jurisdiction.

Liquidity Management

Use stablecoins as flexible working capital for trading, treasury, and operational efficiency.

Hedge Against Currency Friction

Reduce FX slippage and volatility in cross-border flows by leveraging USD-backed stablecoins.

How it Works?

The infrastructure that makes fiat-crypto conversion easy, compliant, and reliable.

Fund Your Account

Deposit in 23 major currencies or transfer digital assets.

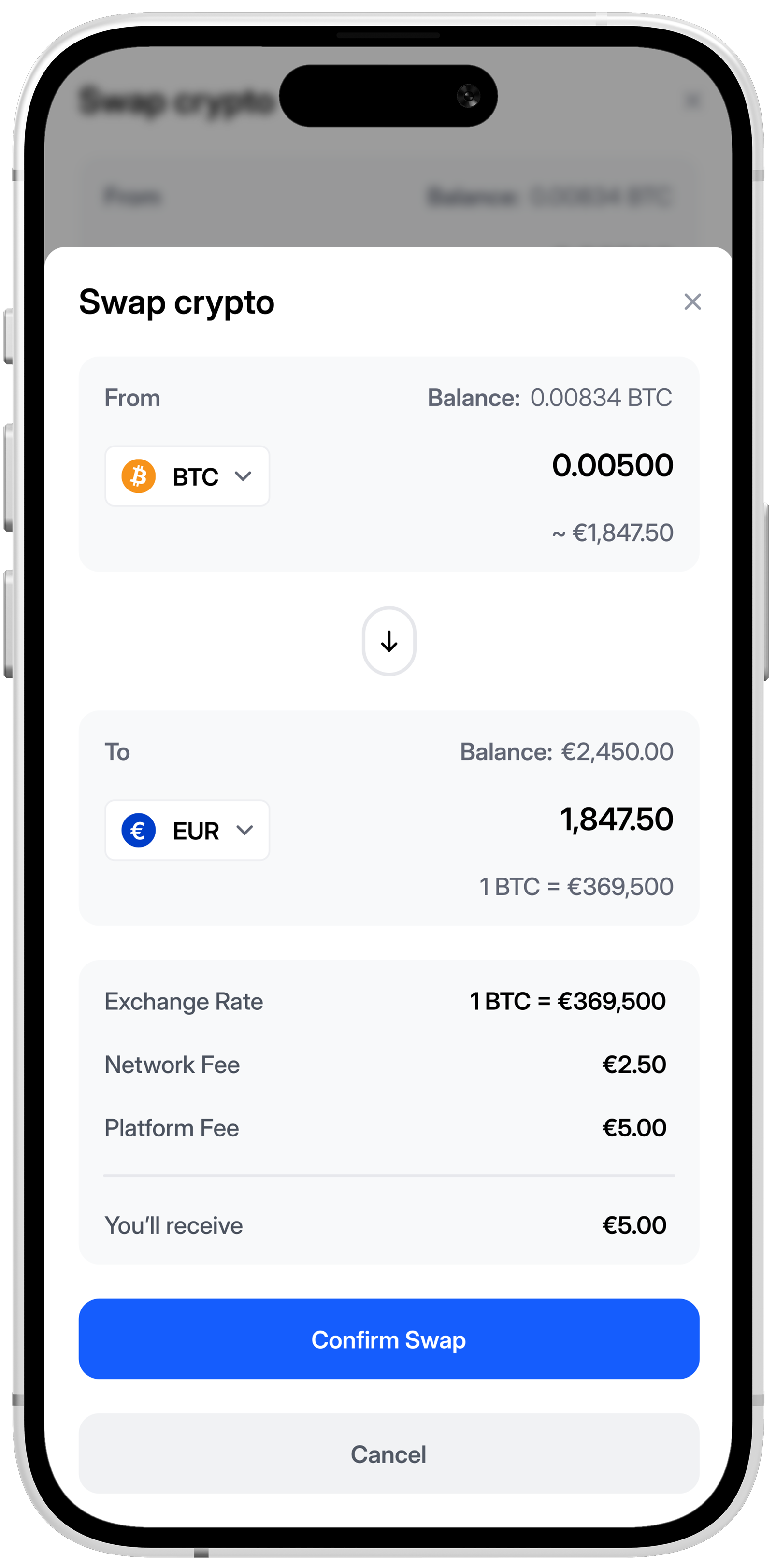

Swap Instantly

Execute conversions between fiat and stablecoins or other digital assets with transparent rates and fees.

Settle and Withdraw

Send funds to bank accounts via supported rails or hold digital assets in your account for liquidity and treasury needs.

FAQ

Answers to the most common questions financial institutions and enterprises have about on/off ramps

An on-off ramp is a financial service that enables the conversion between traditional fiat currencies (like USD, EUR) and digital assets (cryptocurrencies). It provides the infrastructure for businesses and institutions to seamlessly move money between the traditional financial system and blockchain networks.

Stablecoins and digital assets can enhance treasury operations by providing faster settlement times, reducing cross-border transaction costs, enabling 24/7 operations, and offering programmable money features. They can improve liquidity management, reduce counterparty risk, and provide access to new yield-generating opportunities while maintaining regulatory compliance.

Yes, digital asset ramps can significantly reduce foreign exchange and cross-border friction by enabling near-instantaneous settlements, reducing intermediary fees, providing competitive exchange rates, and operating outside traditional banking hours. This results in faster, cheaper, and more efficient international transactions.

No, on-off ramps are designed for all types of businesses, including traditional financial institutions, fintech companies, e-commerce platforms, and enterprises looking to modernize their payment infrastructure. Our solutions are built to integrate seamlessly with existing financial systems and comply with regulatory requirements.

Deposits and withdrawals are processed through secure APIs that connect your platform to our infrastructure. Users can deposit fiat currency through bank transfers or cards, which is then converted to digital assets. Withdrawals work in reverse - digital assets are converted to fiat and sent to designated bank accounts. All transactions include compliance checks, real-time reporting, and audit trails.

Talk to Our Team

Connect with our specialists to structure and execute your digital asset strategy.

Contact Now ›